Building Materials Gst Rate Gst Rates 2020 Goods And Service Tax Rates Slabs Complete List Of Gst Rates 2020

Building materials gst rate Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this article I will talk about about Building Materials Gst Rate.

- Gst Rate Chart For Construction Materials

- Gst Rates On Construction Industry An Analysis

- Is Reduced Gst Rates Applicable For Apartments Booked Prior To April 2019 However Which Is Still Under Construction And Still Payment To Builder Is Due From The Bank Quora

- Gst Rates On Construction Materials Should Be Normalised Gst Station

- Gst Rates 2020 Goods And Service Tax Rates Slabs Complete List Of Gst Rates 2020

- Gst Rates For Cement Mica Asbestos And Stone

Find, Read, And Discover Building Materials Gst Rate, Such Us:

- Gst Rates Chart Gst Rate On Cement Steel Pipes Roofing Sheets And Other Building Materials Implications On Housing Sector The Economic Times

- Real Estate New Gst Rates And Challenges

- Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf

- Gst Revision May Benefit Realty Infra Sectors

- New Gst Structure For Real Estate W E F 1st April 2019

If you re searching for Team Building Ultra League you've reached the ideal location. We ve got 101 graphics about team building ultra league including images, photos, pictures, wallpapers, and more. In such web page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

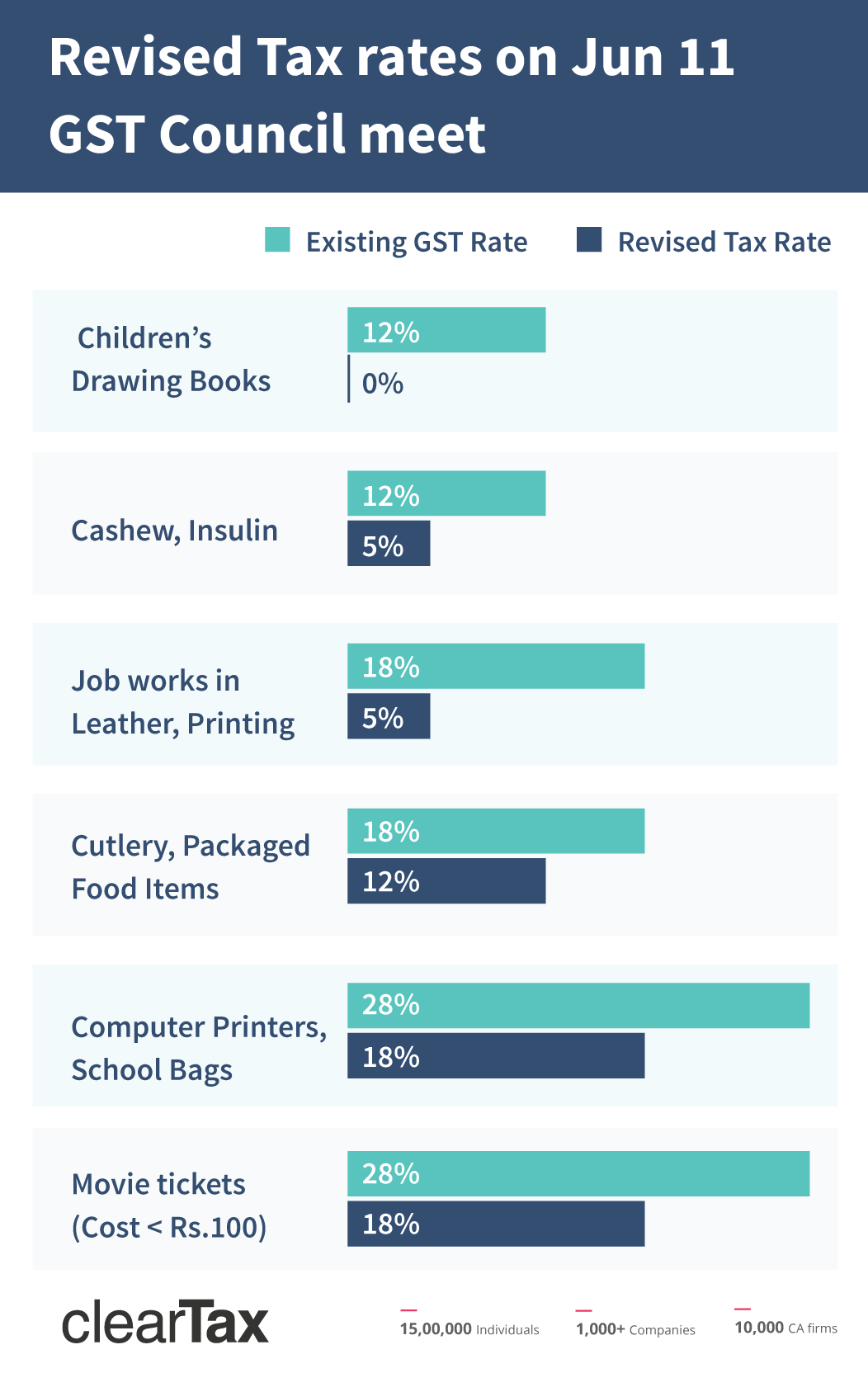

Goods and service tax system was implemented in july 1st across india to replace indirect taxes levied by central state government.

Team building ultra league. Gst rates for all hs codes. Other ornamental goods essentially of stone. Igst 5 sgst 25 csgt 25 igst 12 sgst 6 cgst 6 igst 18 sgst 9 cgst 9.

On the other hand multicellular or foam glass in blocks panels plates shells or similar forms attract a 28 gst. Hard skill assessment building materials rodi 996511 hsn fan rode keychain 96081 960811019 42021 42021190 samak rice disinfection fur nigation services basta file 5000 hair removal strips dispobale waxing strips non woven fabrics waxing strips 3304990 33018 84529099 hsn code gst rate financial service 998346 service tds. Marble and granite blocks have a standard gst rate of 12 percent.

You are adviced to double check rates with gst rate book. Building bricks and bricks of fossil meals attract 5 gst. High or low reliefs crosses figures of animals bowls vases cups cachou boxes writing sets ashtrays paper weights artificial fruit and foliage etc.

Here gst rates on stones building materials means as follows. On the other hand marble and granite other than blocks attract a gst of 28 percent. You can search gst tax rate for all products in this search box.

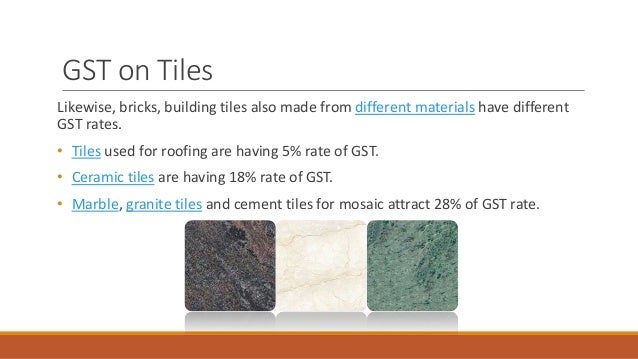

Know the gst rate for cement tmt steel bricks block sand and all other building construction materials. Tiles like bricks attract gst rate in the range of 5 to 28. Sand lime bricks or stone inlay work.

Plus 12 gst is levied on under construction property including on ready to move in flats where completion certification has not been issued at the time of sale. Building bricks and bricks of fossil meals or similar siliceous rock attract 5 gst. You have to only type name or few words or products and our server will search details for you.

Most construction material capital goods and various input services used in buildings attract 18 gst while cement is taxed at 28. Gst on building stones gst on building stones like basalt sandstone porphyry and other sandstones and building stones attract gst of five percent. Know more about gst impact on real estateview briefly about the impact of gst goods and services tax on real estate industry in india.

Tax rates are sourced from gst website and are updated from time to time.

More From Team Building Ultra League

- Building A House Near Me

- School Building Outline Clipart

- Empire State Building List Of Companies

- Building Department Windsor

- Building Materials Za

Incoming Search Terms:

- Kota Stone Hsn Code And Gst Rate Approved By Gst Council Naksh Stone Building Materials Za,

- Gst Rate On Sale Of Scrap Materials With Hsn Code Sag Infotech Building Materials Za,

- L8duq9ql Tvqum Building Materials Za,

- Check The Impact Of Gst On Real Estate Sector In India Sag Infotech Building Materials Za,

- Implication Of Gst On Real Estate Sector Gst India Goods And Services Tax In India Building Materials Za,

- Gst Rates How Is The New Rate Structure Going To Impact You Tfipost Building Materials Za,