Building Construction Gst Rate Impact Of Gst On Contractors And Real State Advisory Tax And Regulatory Compliance In India Singapore And Usa

Building construction gst rate Indeed lately is being sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Building Construction Gst Rate.

- Will Gst Really Revive The Real Estate Sector Valuenotes Strategic Intelligence

- No Extra Gst Burden On Under Construction Buildings Asks Revenue Department

- Gst Council To Consider 5 Gst On Under Construction Homes The Economic Times

- Residential Buildings Not Completed To Choose Between Old Gst And The New Regime The Economic Times

- Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf

- With No Consensus A Cut In Gst Rate On Under Construction Flats Will Take Time The Hindu Businessline

Find, Read, And Discover Building Construction Gst Rate, Such Us:

- Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf

- Gst Rates On Construction Industry An Analysis

- With No Consensus A Cut In Gst Rate On Under Construction Flats Will Take Time The Hindu Businessline

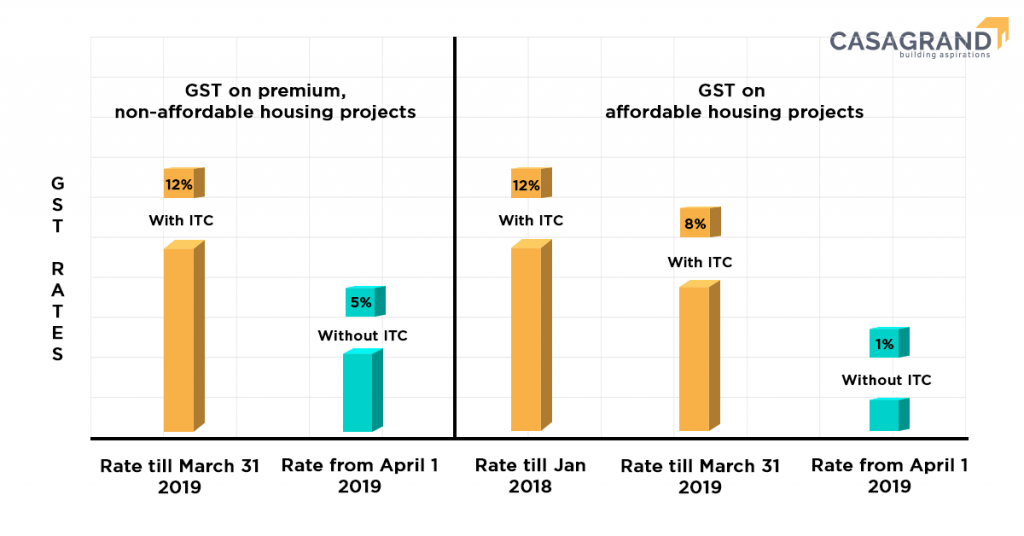

- Gst On Real Estate Reduced 1 For Affordable 5 For Under Construction

- Real Estate Shares Rally On Hopes Of Gst Rate Cut Business Standard News

If you are searching for Building Supplies Quinlan Tx you've arrived at the ideal location. We ve got 104 graphics about building supplies quinlan tx adding pictures, photos, pictures, backgrounds, and more. In such webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

All iron and steel products attract a.

Building supplies quinlan tx. Gst on building and construction. How to calculate gst on under construction property on 1 july 2017 a colossal revolution in regard of taxes payable on the supply of goods and services ie gst has been introduced. Gst on iron and steel.

Gst on building stones like basalt sandstone porphyry and other sandstones and building stones attract gst of five percent. Goods and service tax system was implemented in july 1st across india to replace indirect taxes levied by central state government. Building bricks and bricks of fossil meals attract 5 gst.

Likewise other sectors this comprehensive and multistage tax system has affected the real estate sector to a greater extent. Gst rates for construction sector as amended upto 20 02 2018 by. Gst is set to roll out from 1st july 2017 in india completely overhauling the indirect tax regime.

The proposed gst shall improve the ease of doing business in india and reducing tax burden by eliminating or integrating many of the tax codes. All types of super sulphate slag aluminous and portland cement whether coloured or clinkered attract a standard gst rate of 28 percent. Construction of a complex building civil structure or a part thereof including a complex or building intended for sale to a buyer wholly or partly except where the entire consideration has been received after issuance of completion.

Contract value is 10lakh means if we have gst bill for steel cement tiles etc at the rate of 18 28 what will be the final figure of gst we have to. On the other hand multicellular or foam glass in blocks panels plates shells or similar forms attract a 28 gst. However if youre eligible you can work out your gst liability using the margin scheme.

Your gst rate is 18 and eligible for itc on inward goods and not eligible for inward supply of services and capital goods as per provision of sec54 of cgst act. Know the gst rate for cement tmt steel bricks block sand and all other building construction materials. Generally you pay the normal gst rate of one eleventh of a propertys sale price.

The schedule of gst rates for services as approved by the gst council said that the construction of a complex building civil structure or a part thereof intended for sale to a buyer wholly. Gst rate for construction and building materials. Qi am a gst registered building contractor which is my gst rate 18percentage or 12 percentage for getting input tax credit.

In small building contractors what will be the gst and once we purchased from steel cement and other taxable materials with gst.

Gst Council Okays 5 Rate For Under Construction Properties Ahead Of Polls Business Standard News Building Supplies Quinlan Tx

More From Building Supplies Quinlan Tx

- County Building Control

- Building Supply Jobs Near Me

- Building Supplies Aylesbury

- Building For Sale Edinburgh

- Building Blocks Universe

Incoming Search Terms:

- Detailed Analysis Of Implications Of Gst On Real Estate Sector Building Blocks Universe,

- Gst Rate On Construction Sector Hiked To 18 The Economic Times Building Blocks Universe,

- Construction Sector Buyers Upbeat Over Cut In Gst Rate Easing Of Fsi A2z Taxcorp Llp Building Blocks Universe,

- Gst Impact On Construction Materials Building Blocks Universe,

- Real Estate Shares Rally On Hopes Of Gst Rate Cut Business Standard News Building Blocks Universe,

- Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf Building Blocks Universe,