Building Materials Vat Rate Updated Vat Rate For The Financial Year 2018 2019

Building materials vat rate Indeed lately is being sought by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will talk about about Building Materials Vat Rate.

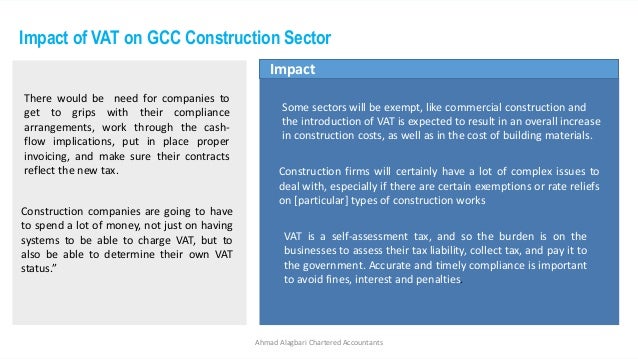

- How Does Vat Work And How Does It Work Entrepreneur Handbook

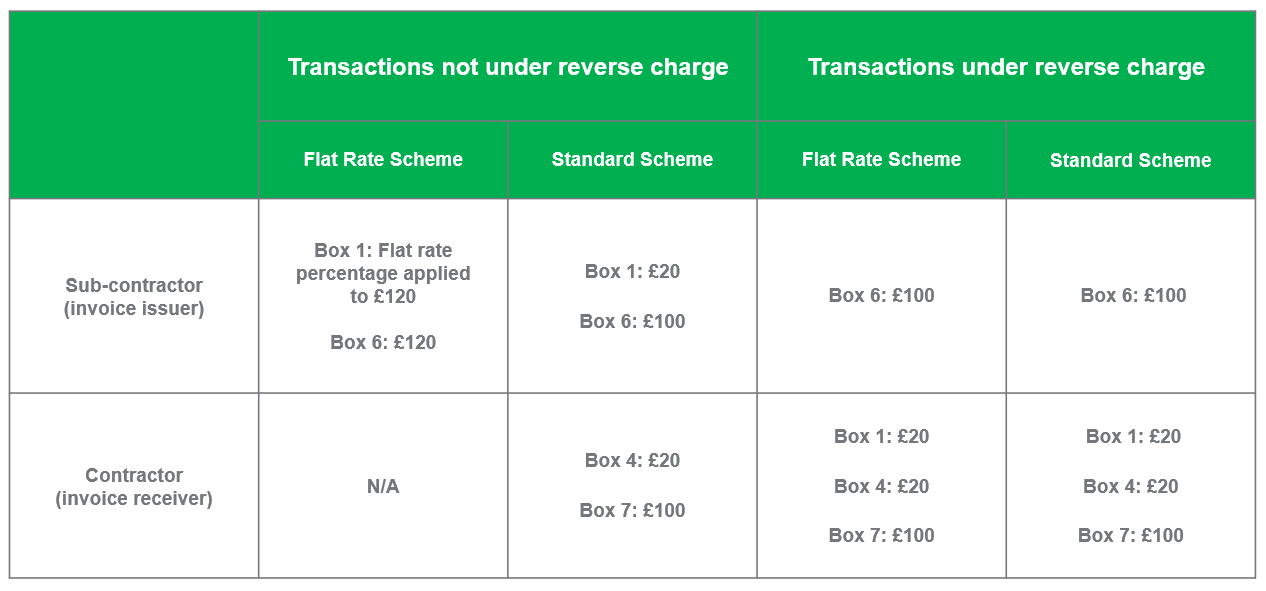

- Construction Vat Reverse Charge Delayed To 2021 Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqfnxkbqic5r8pwex7qgorndm4xvyf5dwpd1kl Px2uidrdv9ru Usqp Cau

- Prices Of Building Materials Register Significant Rise

- Https Inlandrevenue Finance Gov Bs Wp Content Uploads 2018 06 2018 07 01 Vat Guidance Construction Industry Pdf

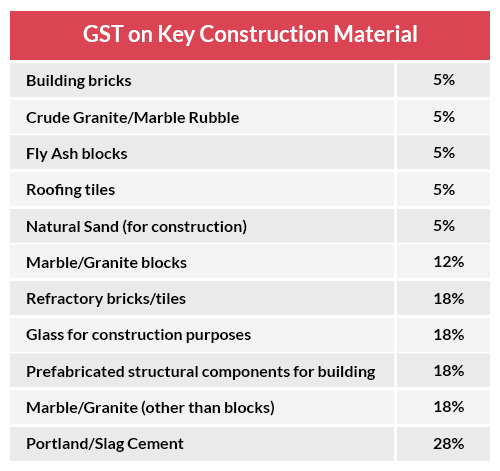

- Gst Rates Chart Gst Rate On Cement Steel Pipes Roofing Sheets And Other Building Materials Implications On Housing Sector The Economic Times

Find, Read, And Discover Building Materials Vat Rate, Such Us:

- Reduced Rate Vat For Barn Conversions Barn Conversion Blog

- Vat On New Build Houses Are They Exempt Design For Me

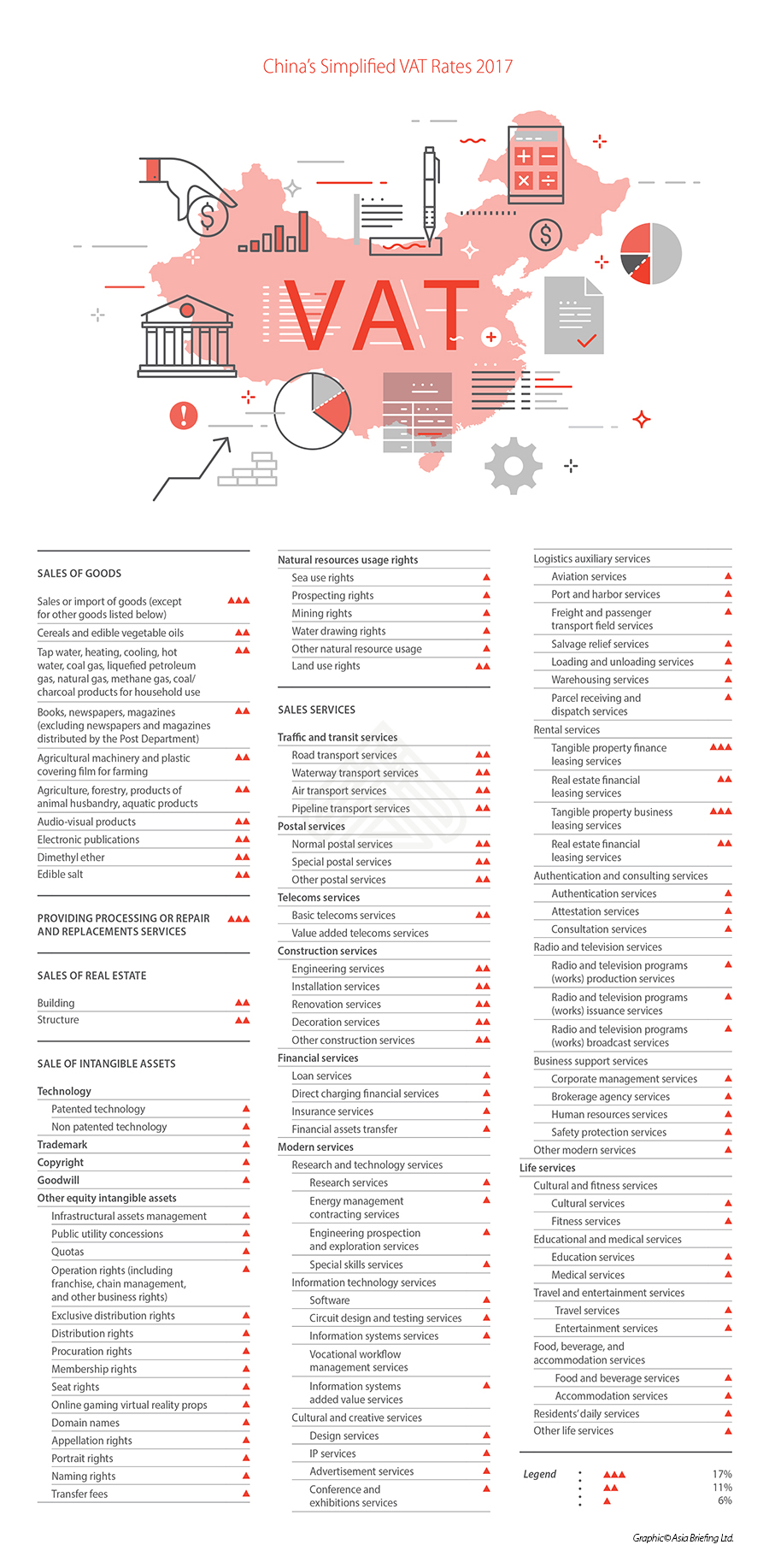

- Https Ec Europa Eu Taxation Customs Sites Taxation Files Resources Documents Taxation Vat How Vat Works Rates Vat Rates En Pdf

- Construction Industry Scheme How Vat Changes Affect You Sage Advice United Kingdom

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrpvfgmhjgd76fvp7rtg7kmx0tly3byk6pwzwlrcdeg73uyhp9r Usqp Cau

If you re searching for Building Blocks Javascript you've come to the right place. We have 104 images about building blocks javascript adding pictures, photos, photographs, backgrounds, and more. In such webpage, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Builders charge vat on building materials that they supply and incorporate in a building or its site at.

Building blocks javascript. These particular materials are liable to vat at the reduced rate. Excluding materials referred to in paragraphs 161 and 162 of schedule 3 such as concrete ready to pour and concrete blocks as defined. Vat for most work on houses and flats by builders and similar trades like plumbers plasterers and carpenters is charged at the standard rate of 20 but there are some exceptions.

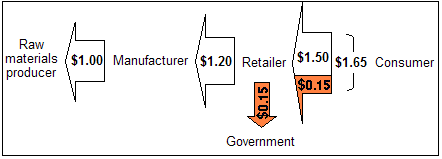

Value added tax consolidation act 2010 vatca 2010 ref. Retailers and builders merchants charge vat at the standard rate on most items they sell. The 5 rate applies to building services and related materials supplied by the building contractor but not to separately purchased building materials for example purchases from builders merchants.

The lower rate applies to the following works. The way you describe the system is how it should work that is the builder charges a flat rate 135 for the materials labour and gross profit margin. In certain circumstances some building work is subject to a lower vat rate of 5.

By andrew needham may 2016 andrew needham looks at the 5 vat rate for building work and when a certificate is required.

More From Building Blocks Javascript

- Building A House Read Aloud

- Building Department Aventura

- Building Construction Engineering

- Team Building Artinya

- School Building In Japan

Incoming Search Terms:

- Rationalise Gst On Building Material School Building In Japan,

- School Building In Japan,

- Vat Reverse Charge For Construction Services Taxation School Building In Japan,

- Domestic Reverse Charge Vat For Construction Services School Building In Japan,

- Recycled Building Materials Struggle For Development School Building In Japan,

- Revised Gst Slab Rates In India Fy 2020 21 Finalized By The Gst Council School Building In Japan,